This needs to be a global dialogue between the financial industry, governments, companies and individuals more broadly.

We have to be better at connecting to individuals, explaining how their investments today will deliver the financial outcomes they need in the future. Asset managers have an obligation to educate, empower and prepare people with the investment solutions, technology and mindset required to invest for the long term. The need for asset management is greater than ever. And we, as a firm and as an industry, have to provide it. People want help and guidance in reaching those goals. And their financial goals are investing for retirement, buying a house, paying for college. They are mothers, fathers and grandparents. Our clients are teachers, nurses, firefighters, CIOs of foundations and pensions, scientists, business professionals and so many others. Our responsibility as a fiduciary is profound. Our purpose as a firm – and as an industry – has to be broader than tracking error or alpha generation. Sustainable return on investments in actual dollars is what is ultimately required. And while these metrics are an important component of portfolio return, alpha doesn’t pay pensions. The goal of managers has been to deliver returns either in excess of or in line with a particular market benchmark over a 1-year, 3-year or 5-year period.

How can we help pension funds manage their growing liabilities in the face of low rates and underfunding? How can we use technology to make it easier for individuals to invest for retirement? How can we build resilient model portfolios for financial advisors to use with their clients?įor far too long, asset managers have focused on selling products without placing them in a broader context. We don’t start with products, but rather by asking what our clients need in order to achieve their most important financial goals. It is lived and breathed every day, not just by the founders and early employees, but by the firm’s next generation of leadership.Įvery day, we discuss the long-term needs of our clients and the people they serve. That approach has been embedded in BlackRock’s culture since 1988. And – despite my better judgment – I keep the television on in my office.īut in the conversations I have with clients and in the work I undertake with the leadership of BlackRock, my focus is resolutely on the long term. During the day, I glance over at the market data on my monitors more times than I care to admit. I feel the pressure to react to the short term in my own daily routine: I wake up in the morning with dozens of news notifications on my phone.

BLACKROCK CEO LETTER HOW TO

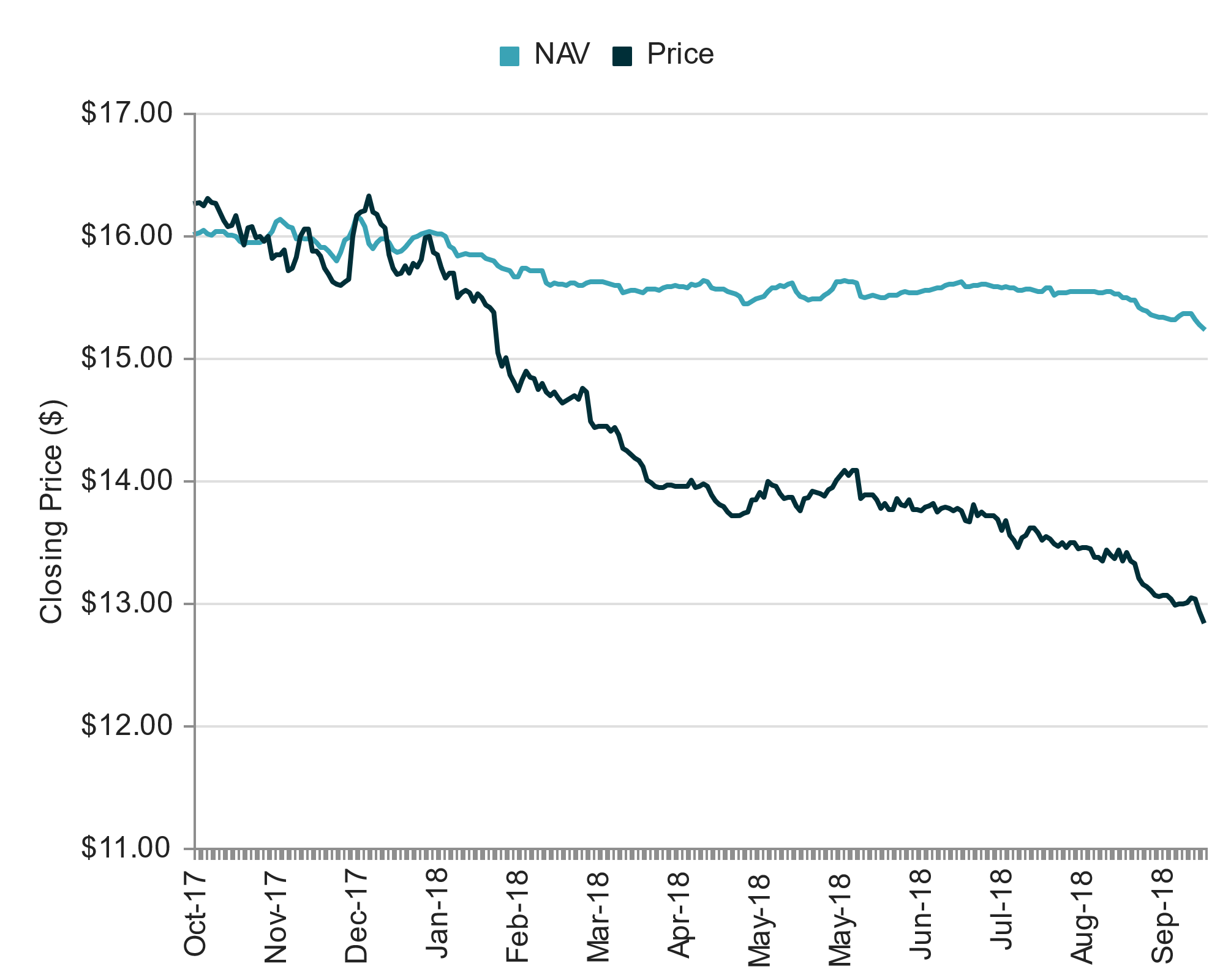

How to tune out the noise and prepare for the long term. How to plan for a future measured in decades, not hours. Everything centers on the present moment – what to do today, only to do something else tomorrow.īut there is far too little conversation about long-term goals and outcomes. Banks and brokers make money on the velocity of trading and financial news makes money talking about that velocity. There is a focus on speed and a lack of substance. Almost fittingly – and sadly – the year was capped off by the longest government shutdown in US history.Īgainst this backdrop of financial and geopolitical uncertainty, I believe that people are increasingly frustrated with the culture of investing and the structure of financial markets. Trade disputes alternately simmered and flared in 2018, driving further fear about the global economy. Rising populism, the source of protests in France and new governments in Mexico, Italy and Brazil, continues to transform the geopolitical landscape and how investors think about the world. Brexit has been a deeply chaotic process, causing uncertainty and unnecessary costs for nearly every global business. But the year itself saw many unsettling events. As a long-term optimist, I believe that some of the political and economic debates we are seeing, although certainly not all, can help play a role in establishing a fairer global economy. It was also a year of political turbulence. Simply put, people are increasingly unsure where they can find returns to support their future needs. While US short-term rates surpassed 2%, making cash a more profitable placeholder investment, that return is not enough to sustain the long-term objectives of most savers. But last year – for only the second time in the past three decades – global stock and bond markets both delivered negative returns. Markets have experienced bouts of volatility several times over the last decade. The year began with equity markets at record highs, which persistently moved downward throughout the year, and investors’ fears of a recession intensified. What was it about last year? In the markets, there was a heightened sense of uncertainty.

0 kommentar(er)

0 kommentar(er)